Your MVCU online and mobile banking are getting a refresh! The cleaner design and simpler navigation menu will help you easily accomplish your day-to-day banking needs. The brand new look will help you quickly and conveniently access key services and tools so you can bank anytime, anywhere.

To access all of the new features, you will need the most up-to-date version of the app. There are two ways to get the updated version:

If you receive automatic updates for your MVCU Mobile app, you're all set!

If you don't, here's how you can change your settings:

Here's how:

The newly designed app is on its way later this month!

Recommendation for all mobile users: Set your app to automatically update to get upgrades as soon as they are available. If your app does not automatically update, you will have to download the updated version from the App Store or Google Play.

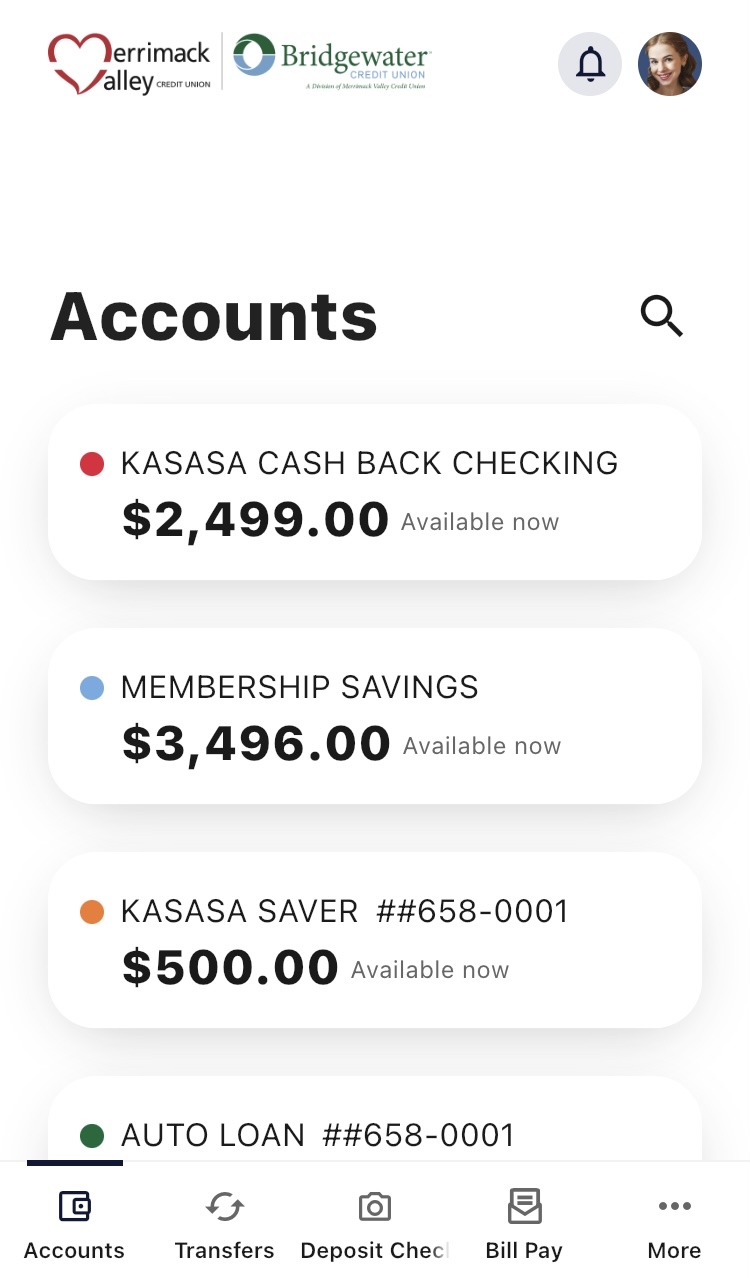

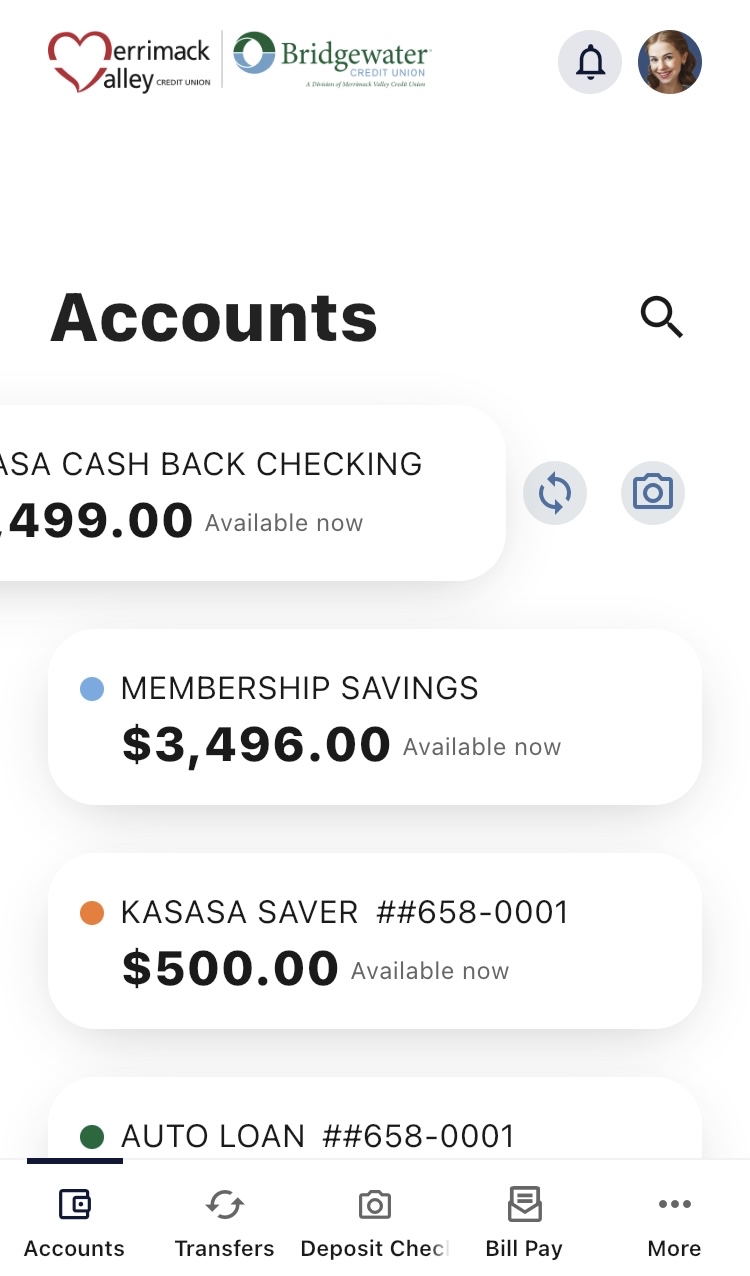

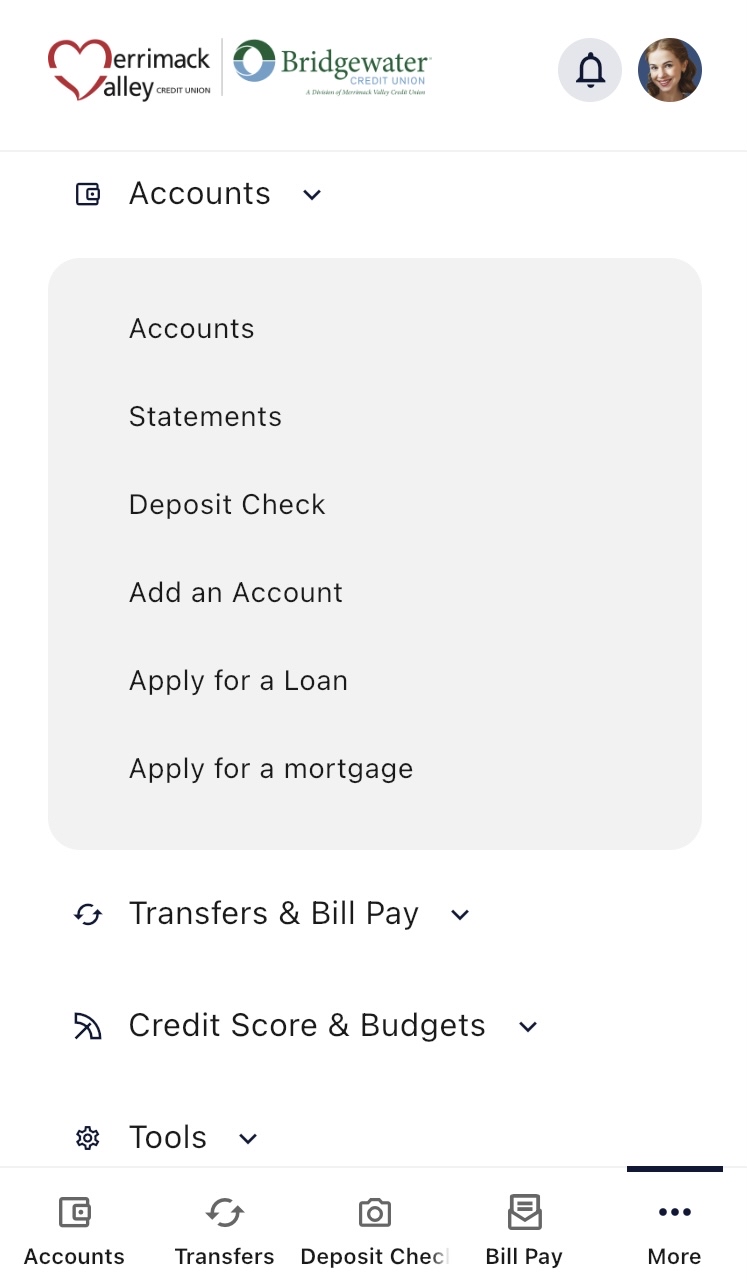

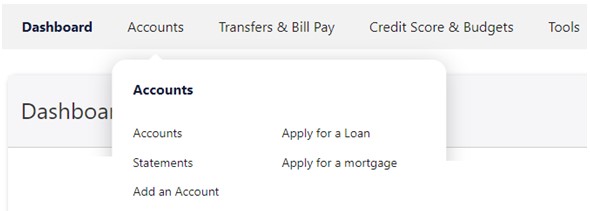

When you login, you'll notice the menu is now across the top of your Dashboard. There are five categories containing all of the services and tools to make access and navigation simple.

Here's an easy guide to the categories:

Access all of the great features in online banking on your mobile device!

Features: